Get All Tools for FREE!

Get All Tools for FREE!

Click here to open a trading account using our referral link and start trading.

After 7 days of active trading under our referral link, you can get access to all tools in your account.

Keep trading to keep access free — if you're inactive for 7 days, your access will be removed.

Already have an account? You can change the IB (introducing broker) to our referral link ( https://one.exnesstrack.org/a/w7syl3vnjb ) and still qualify!

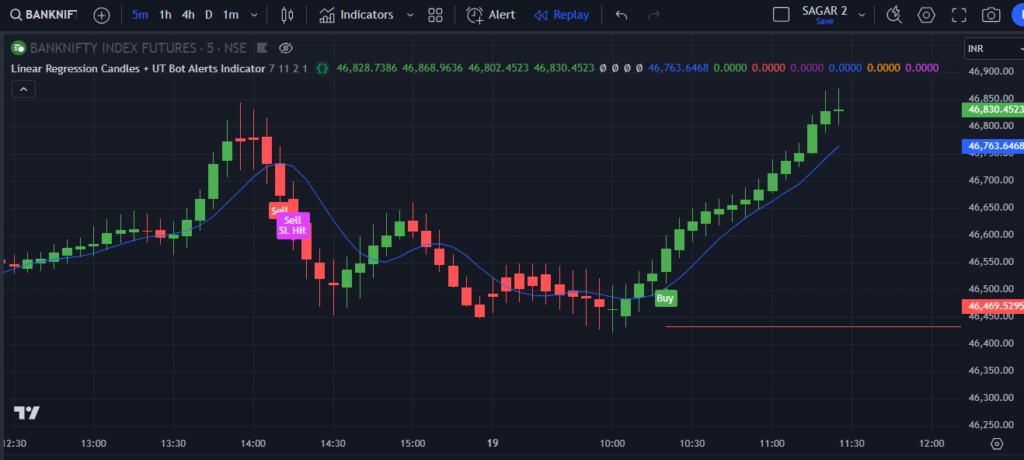

TradingView has become one of the most popular platforms for traders to analyze the financial markets, thanks to its vast array of tools and indicators that cater to both novice and experienced traders. One powerful combination that traders can leverage is the Linear Regression Candles and UT Bot Alerts strategy. This strategy uses advanced features in PineScript to deliver clearer and more accurate market signals for both entry and exit points.

In this guide, we will explore what this strategy is, how it works on TradingView, and how you can use it effectively to improve your trading decisions.

Get All Tools for FREE!

Get All Tools for FREE!

Click here to open a trading account using our referral link and start trading.

After 7 days of active trading under our referral link, you can get access to all tools in your account.

Keep trading to keep access free — if you're inactive for 7 days, your access will be removed.

Already have an account? You can change the IB (introducing broker) to our referral link ( https://one.exnesstrack.org/a/w7syl3vnjb ) and still qualify!

What Is the Linear Regression Candles and UT Bot Alerts Strategy?

The Linear Regression Candles and UT Bot Alerts strategy combines two powerful tools that simplify decision-making when trading.

- Linear Regression Candles:

- These candles smooth out the volatility in the market by creating a visual representation of price action that follows the trend more closely. Linear Regression candles are especially useful for identifying market trends and reducing noise that often leads to false signals.

- UT Bot Alerts:

- The UT Bot Alerts indicator gives buy or sell signals based on key levels in the market. These alerts are derived from price action and trend analysis, offering a clear and actionable signal for entering and exiting trades.

Together, these tools provide traders with enhanced market clarity, allowing for more precise entries and exits with improved risk management.

How Does the Strategy Work on TradingView?

TradingView’s PineScript makes it easy for traders to implement this strategy. By integrating Linear Regression Candles and the UT Bot Alerts, traders can set up their charts to follow the strategy rules, making it easy to spot high-probability trade opportunities. Here’s how to set up and use this strategy effectively:

Step 1: Setting Up the Indicators on TradingView

To implement this strategy on TradingView, you need to set up two key indicators:

- Linear Regression Candles:

- Instead of using traditional chart candles, you will use the Linear Regression Candles indicator to smooth out the price movements. This provides a clearer picture of the market’s overall direction.

- UT Bot Alerts:

- For the UT Bot Alerts, set the Key Value to 1 and the ATR Period to 1. This ensures that the UT Bot gives signals based on specific levels of market volatility and price action.

Step 2: Applying Strategy Rules

Once the indicators are set up, the next step is to follow the strategy rules. The rules are straightforward and are designed to give clear buy and sell signals.

Buy Signal:

- The UT Bot must give a buy signal, and the Linear Regression Candle should close above the Linear Regression line. This indicates that the market is likely turning bullish, and it is a good time to enter a trade.

- Stop-Loss: The recent swing low should be used as the stop-loss point. This minimizes the risk if the market reverses unexpectedly.

- Exit: Exit the position when there are two consecutive red candles, signaling a potential reversal or a weakening of the bullish trend.

Sell Signal:

- The UT Bot must give a sell signal, and the Linear Regression Candle should close below the Linear Regression line. This indicates that the market is turning bearish, and it is a good time to take a short position.

- Stop-Loss: The recent swing high should be used as the stop-loss point. This protects you from large losses in case the market goes against your position.

- Exit: Exit the position when there are two consecutive green candles, which indicate that the downtrend may be losing momentum and a bullish reversal is possible.

Why Use the Linear Regression Candles and UT Bot Alerts Strategy?

There are several advantages to using the Linear Regression Candles and UT Bot Alerts strategy on TradingView:

- Improved Accuracy:

- The Linear Regression Candles filter out market noise, allowing traders to see the overall trend more clearly. This reduces the chances of getting caught in false signals, which is a common issue with traditional candlestick charts.

- Clear Entry and Exit Points:

- The strategy provides traders with specific, easy-to-follow rules for when to enter and exit trades. The buy and sell signals from the UT Bot Alerts and the confirmation from the Linear Regression Candles make it easier to spot high-probability trades.

- Better Risk Management:

- By using the recent swing low for buy orders and the recent swing high for sell orders as stop-loss levels, traders can better protect their capital and minimize potential losses.

- Versatile for Different Market Conditions:

- This strategy works well in both trending and sideways markets. The Linear Regression Candles smooth out the noise in sideways markets, and the UT Bot Alerts provide signals for trend reversals, helping traders make decisions during both bullish and bearish phases.

How to Maximize Your Success with This Strategy

While the Linear Regression Candles and UT Bot Alerts strategy offers clear guidelines, there are still several tips you can follow to maximize your success:

- Use the Strategy in Conjunction with Other Indicators:

- Although this strategy is powerful on its own, consider combining it with other indicators, such as volume analysis or momentum oscillators (RSI or MACD), for additional confirmation of signals.

- Adjust the Timeframes:

- This strategy can be used on different timeframes, but it is most effective on shorter timeframes such as the 5-minute chart. Experiment with different timeframes to find what works best for your trading style.

- Always Practice Proper Risk Management:

- As with any trading strategy, never risk more than you can afford to lose. Set stop-loss levels at the right points and adjust your position size according to your risk tolerance.

- Be Patient and Wait for Confirmation:

- The key to success with this strategy is patience. Do not rush into trades. Wait for the UT Bot Alerts to confirm the signal and for the Linear Regression Candle to close above or below the regression line before entering a position.

Conclusion

The Linear Regression Candles and UT Bot Alerts strategy on TradingView is an excellent tool for traders looking to improve their entry and exit strategies. By using PineScript to combine these indicators, traders can make better-informed decisions, reduce market noise, and increase their chances of success.

By following the simple yet effective rules for buy and sell signals, along with proper risk management techniques, you can significantly enhance your trading performance. Whether you’re a beginner or an experienced trader, this strategy provides a reliable framework for navigating the markets with greater confidence.

Incorporating the Linear Regression Candles and UT Bot Alerts strategy into your trading plan can help you capture profitable opportunities, minimize risks, and improve your overall trading experience.

Pinescript of Linear Regression Candles and UT Bot Alerts Strategy TradingView Indicator :

Contact us at +91 7620658346 to get access to this powerful indicator! We specialize in algorithm development for TradingView indicators, MT4/MT5 strategies, and trading bots.

Stay connected with us on Instagram, YouTube, and Twitter: @algo_aakash for the latest updates and insights!

Disclaimer

The information provided in this article and any related indicators is for educational purposes only. Trading financial markets involves significant risk, and there are no guarantees of profit. The custom Bollinger Band strategy is based on historical data and technical analysis, which may not necessarily reflect future market movements. Users should conduct their own research, assess their risk tolerance, and consult with a licensed financial advisor before making any trading decisions. The author and developer of this indicator are not responsible for any losses incurred through the use of this strategy. Please trade responsibly.

Click here to explore this indicator.

Get This Tool for FREE!

Get This Tool for FREE!

Click here to open a trading account using our referral link and start trading.

Use coupon code: FREE during checkout.

After 7 days of active trading under our referral link, you’ll get access to this tool in your account.

Keep trading to keep access free — if you're inactive for 7 days, your access will be removed.

Already have an account? You can change the IB (introducing broker) to our referral link and still qualify!

0 Comments