🔓 Get All Tools for FREE!

- ✅ Click here to open a trading account using our referral link and start trading.

- 📅 After 7 days of active trading under our referral link, you can get access to all tools in your account.

- ⚠️ Keep trading to keep access free — if you're inactive for 7 days, your access will be removed.

- 👉 Already have an account? You can change the IB (introducing broker) to our referral link ( https://one.exnesstrack.org/a/w7syl3vnjb ) and still qualify!

In the trading world, strategies that aim to maximize profits while minimizing risks are highly sought after. One such strategy, the Martingale Strategy, has garnered attention for its potential to recover losses, although it is often considered a high-risk approach. Whether you’re using MT4 (MetaTrader 4) or another platform, understanding how the Martingale strategy operates can help you make more informed decisions. This article will explain how the Martingale strategy works, particularly within the context of a Breakout Strategy, and how to implement it using an MT4 Expert Advisor (EA).

What is the Martingale EA Strategy?

The Martingale strategy is a well-known trading technique that aims to recover losses by increasing the size of the next trade following a loss. The underlying principle is that a losing streak will eventually be broken, allowing the trader to recover all previous losses with a single winning trade. While this can be a powerful strategy, it carries significant risk because the position sizes grow exponentially after each loss. Without proper risk management, traders can face massive losses if a prolonged losing streak occurs.

🔓 Get All Tools for FREE!

- ✅ Click here to open a trading account using our referral link and start trading.

- 📅 After 7 days of active trading under our referral link, you can get access to all tools in your account.

- ⚠️ Keep trading to keep access free — if you're inactive for 7 days, your access will be removed.

- 👉 Already have an account? You can change the IB (introducing broker) to our referral link ( https://one.exnesstrack.org/a/w7syl3vnjb ) and still qualify!

Indicator Overview: Breakout Strategy

In the context of trading, a Breakout Strategy involves identifying key levels of support and resistance. When the price breaks through these levels, it signals a potential trend reversal or continuation. By combining the Martingale strategy with a Breakout Strategy, traders can attempt to capitalize on significant price movements that occur when these levels are broken.

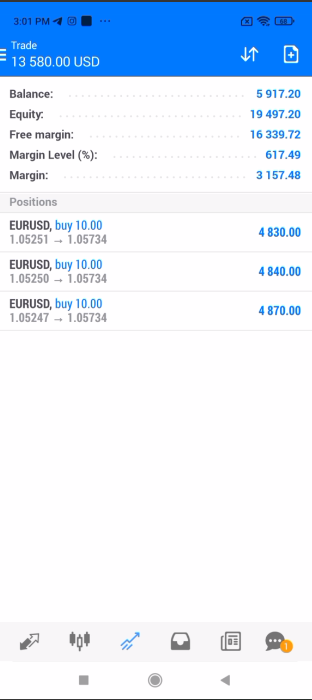

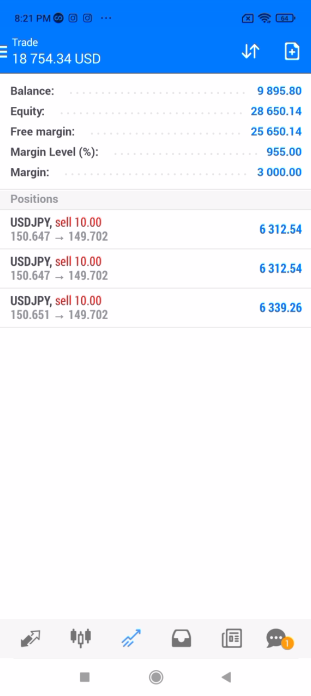

The idea behind the Martingale Breakout Strategy is to enter a trade when the price breaks out of a predefined range and use the Martingale approach to adjust trade sizes in case the trade moves against you. Let’s explore how this setup works in practice.

How Does the Martingale Indicator Work in an MT4 Expert Advisor (EA)?

An Expert Advisor (EA) in MT4 is an automated trading system that executes trades on your behalf based on predefined rules. To implement the Martingale Breakout Strategy in MT4, the EA needs to follow a few basic principles:

- Initial Trade: The Martingale strategy starts by opening a small position. The size of this position is typically low, as the initial trade is meant to test the market’s direction. If the trade is successful, profits are locked in.

- Loss Recovery: If the initial trade results in a loss, the Martingale EA automatically doubles the lot size for the subsequent trade. This trade aims to recover the loss from the previous trade and generate a profit. By doubling the position size, the idea is that a winning trade will cover both the original loss and the new trade’s potential profit.

- Gap Setting: In addition to defining trade size, you can set a gap or distance that the price must move before the Martingale EA enters a trade. This gap helps to ensure that the EA only places trades when significant price movement occurs, avoiding small market fluctuations that may not be profitable.

- Take Profit: A crucial feature of the Martingale strategy is the take-profit level. When the price reaches a predetermined profit target, the EA automatically closes all open positions. This ensures that the system locks in profit and covers any previous losses.

Pros and Cons of the Martingale Strategy

Pros:

- Loss Recovery: The primary benefit of the Martingale strategy is the ability to recover losses by increasing trade size after each loss.

- Automation: The MT4 EA automates the process, reducing emotional decision-making and ensuring trades are executed as planned.

- Scalability: The Martingale strategy can be adjusted to suit various account sizes and risk appetites.

Cons:

- High Risk: The most significant downside is the risk of large losses, especially during prolonged losing streaks. Doubling lot sizes can lead to significant drawdowns.

- Capital Intensive: This strategy requires substantial capital to withstand consecutive losses.

- Overtrading: Without proper risk management, this strategy can lead to overtrading and exposure to high-risk situations.

Conclusion

The Martingale strategy can be a powerful tool when combined with a Breakout Strategy on MT4 using an Expert Advisor (EA). By automating the Martingale approach, you can manage your trades and potentially recover losses after a losing streak. However, it’s crucial to approach this strategy with caution due to the risks involved. Make sure to test your EA thoroughly, implement proper risk management practices, and adjust the parameters to suit your trading style and risk tolerance.If you don’t have a TradingView account, click here to sign up. Once you’re registered, click the link below to access the indicator.

Disclaimer

The content in this article, including any related indicators, is provided for educational purposes only. Trading in financial markets involves significant risk, and profits are not guaranteed. Understanding the Martingale EA Strategy is derived from historical data and technical analysis, which may not accurately predict future market movements. Users should conduct their own research, evaluate their risk tolerance, and seek advice from a licensed financial professional before making trading decisions. The author and creator of this indicator are not liable for any losses resulting from its use. Please trade responsibly.

0 Comments